Investor Targeting moves into focus under MiFID II

With the roll-out of MiFID II, active investor targeting has become increasingly important for investor relations managers. Since MiFID II, costs of services related to the trading of securities must be separated from the costs of other securities-related services. As a result activities related to identifying and approaching investors must also be invoiced separately. Instead of allocating budgets to brokers and banks, companies are turning to active investor targeting.

For proactive investor targeting

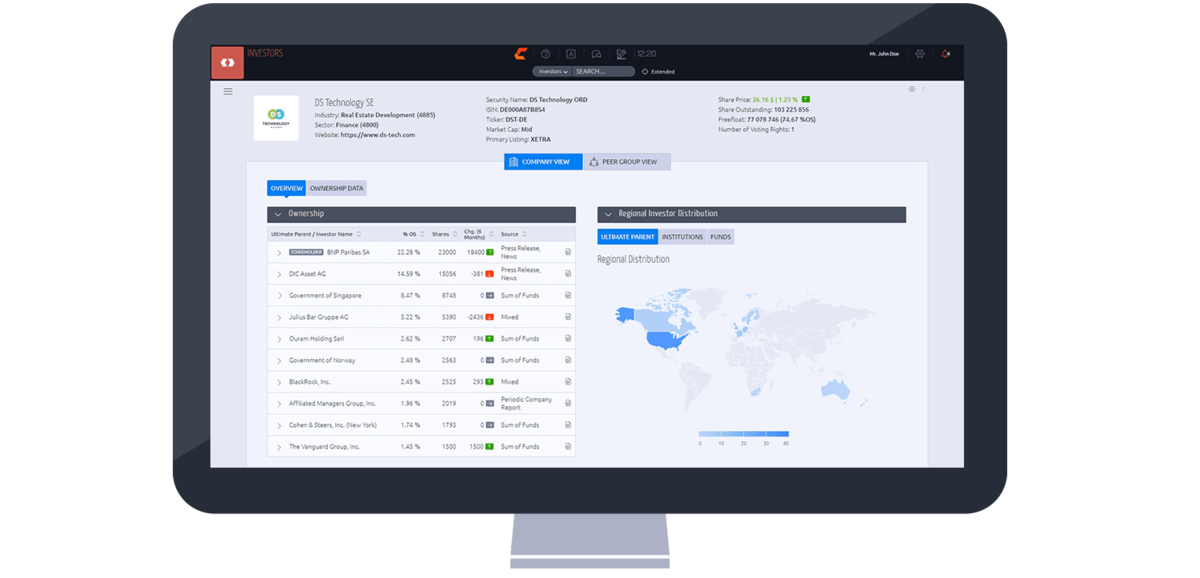

With the Investors module of the EQS IR COCKPIT you can pursue active investor targeting and identify and evaluate existing and potential investors.

- Investor structure

The Investors module provides information on your existing investors.

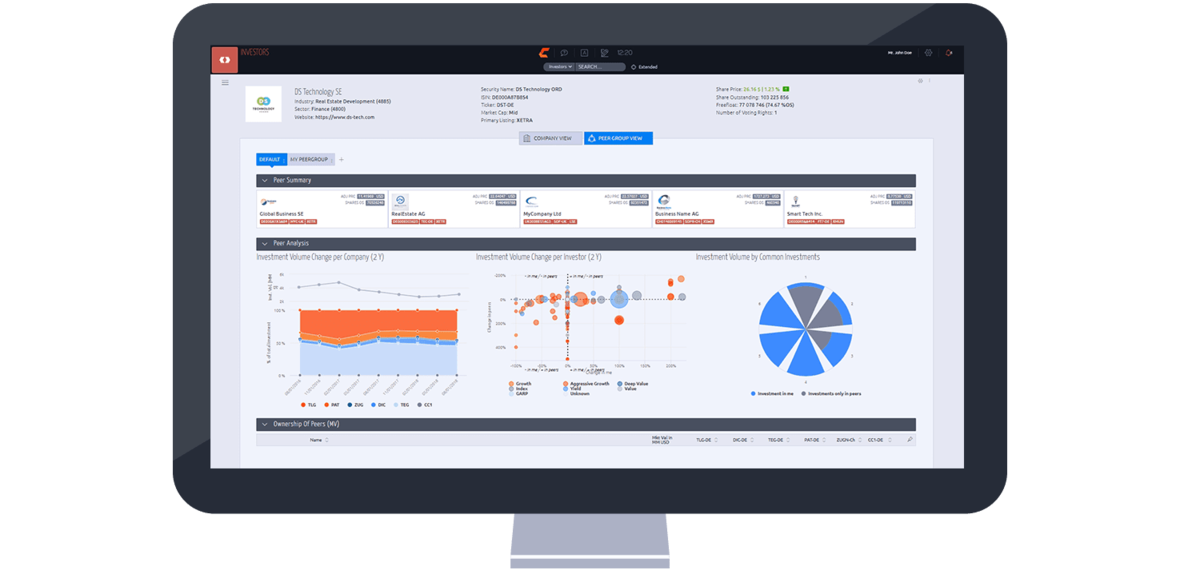

- Peer Groups

Research who has invested in your peers in order to identify potential future investors.

- Investor evaluation

Evaluate the quality and potential of investors based on data. This enables you to identify relevant investors and manage activities and resources according to your needs.

The best investor data on the market

For our Investors module, we work together with FactSet and obtain data up to individual level so that we can provide you with the best quality investor data on the market. We prepare the data in such a way that you receive the desired information quickly.

With this information, you can:

- independently identify relevant investors rather than being dependent on brokers and banks,

- assess the quality of investor contacts and allocate costs accordingly,

- better evaluate the performance of intermediaries in addressing investors (brokers, banks).