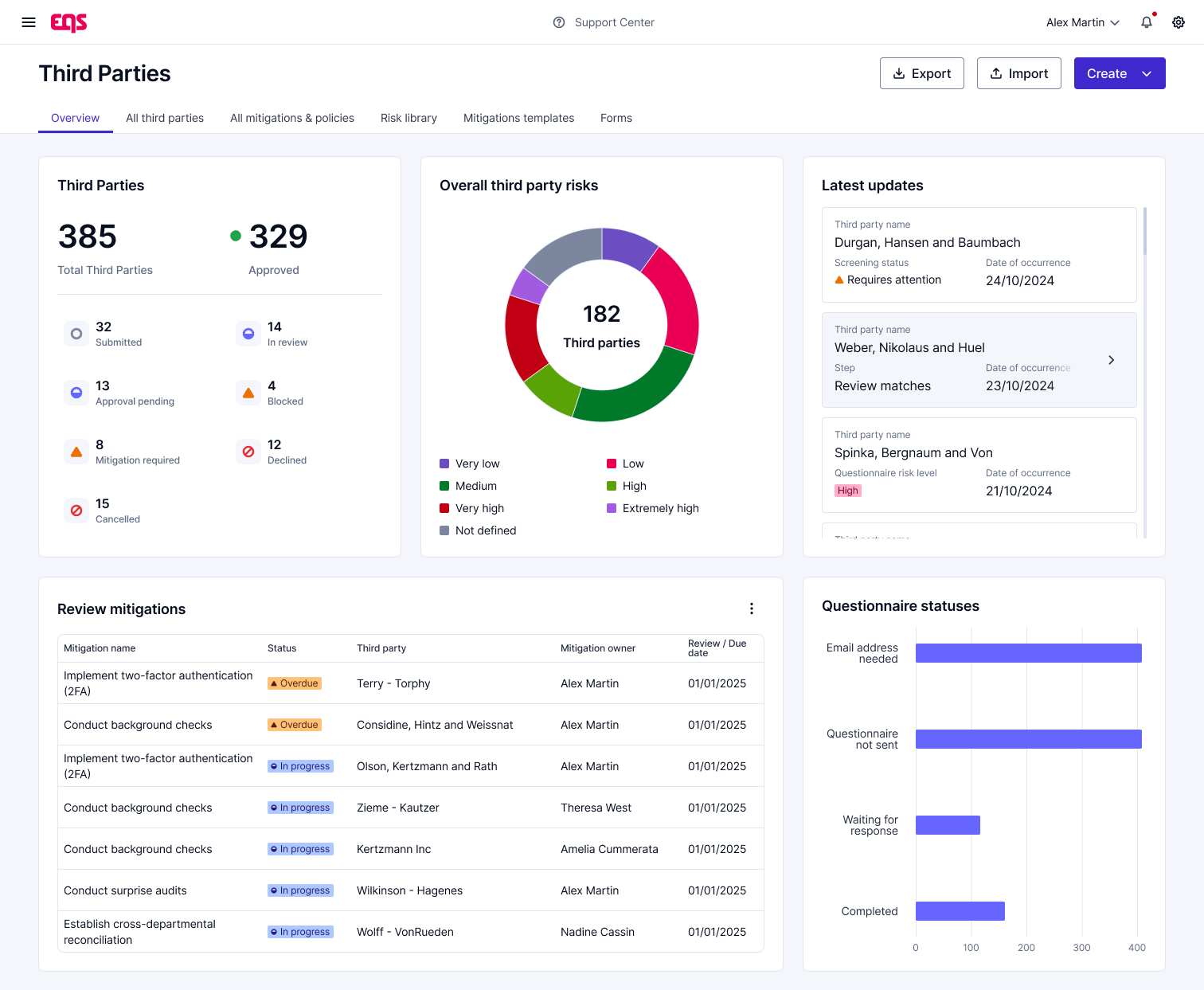

THIRD PARTIES

Third-party risk management software for structured, audit-ready compliance

The third-party risk management tool for thorough traceability of external risk measures

Third-party compliance touches every part of the business, yet the information that supports it is often fragmented. As risk programs expand, it becomes harder to track where data sits, who owns which risks, and whether policy attestations are consistently logged. We bring structure to this complexity by providing a connected process to gather the right information, assess it, and document all decisions with full confidence.

Trusted by leading organizations worldwide

Security & compliance certifications

At EQS Group, protecting your data is our highest priority. EQS Policies meets the strictest IT security standards and ensures full compliance with GDPR and the EU Whistleblowing Directive.

Data Protection

- ISO/IEC 27001 certified infrastructure

- 2048-bit end-to-end encryption

- GDPR Article 25 compliant by design

- No metadata collection or IP tracking

Ongoing Security

- Annual penetration testing (OWASP standards)

- ISAE 3000 Type II audits by PwC

- Cloud Security Alliance certified and STAR registered

- 100% renewable energy hosting

Why compliance teams choose Third Parties

Scaling a third-party program often outpaces the systems supporting it. Information spreads across emails, spreadsheets, questionnaires, and shared folders, making it difficult to track what was collected, reviewed, and still needs attention.

Third Parties changes this by giving you a clear, connected process where every piece of your due diligence process fits together

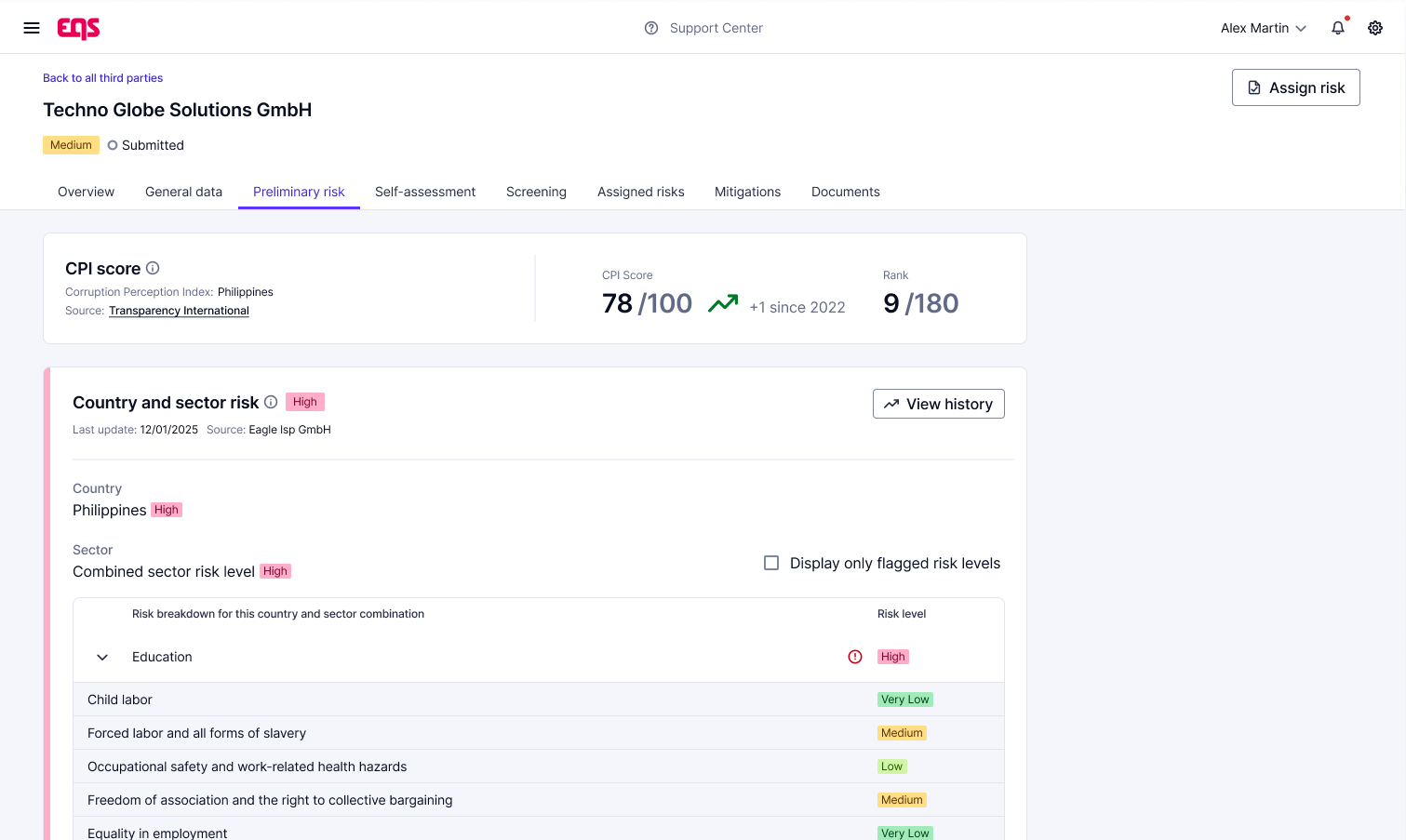

Unified profiles for complete risk visibility

All data, assessments, risk indicators, screening results, mitigations, and policy attestations reside in one organized place. There is no confusion over files or versions, only a clear, connected view of every relationship.

Policy attestations built into one process

Upload a policy in the Policies module and capture attestations automatically. Every attestation is tied to the correct policy version with a time-stamped record that withstands internal reviews and external audits.

Oversight that keeps your program on track

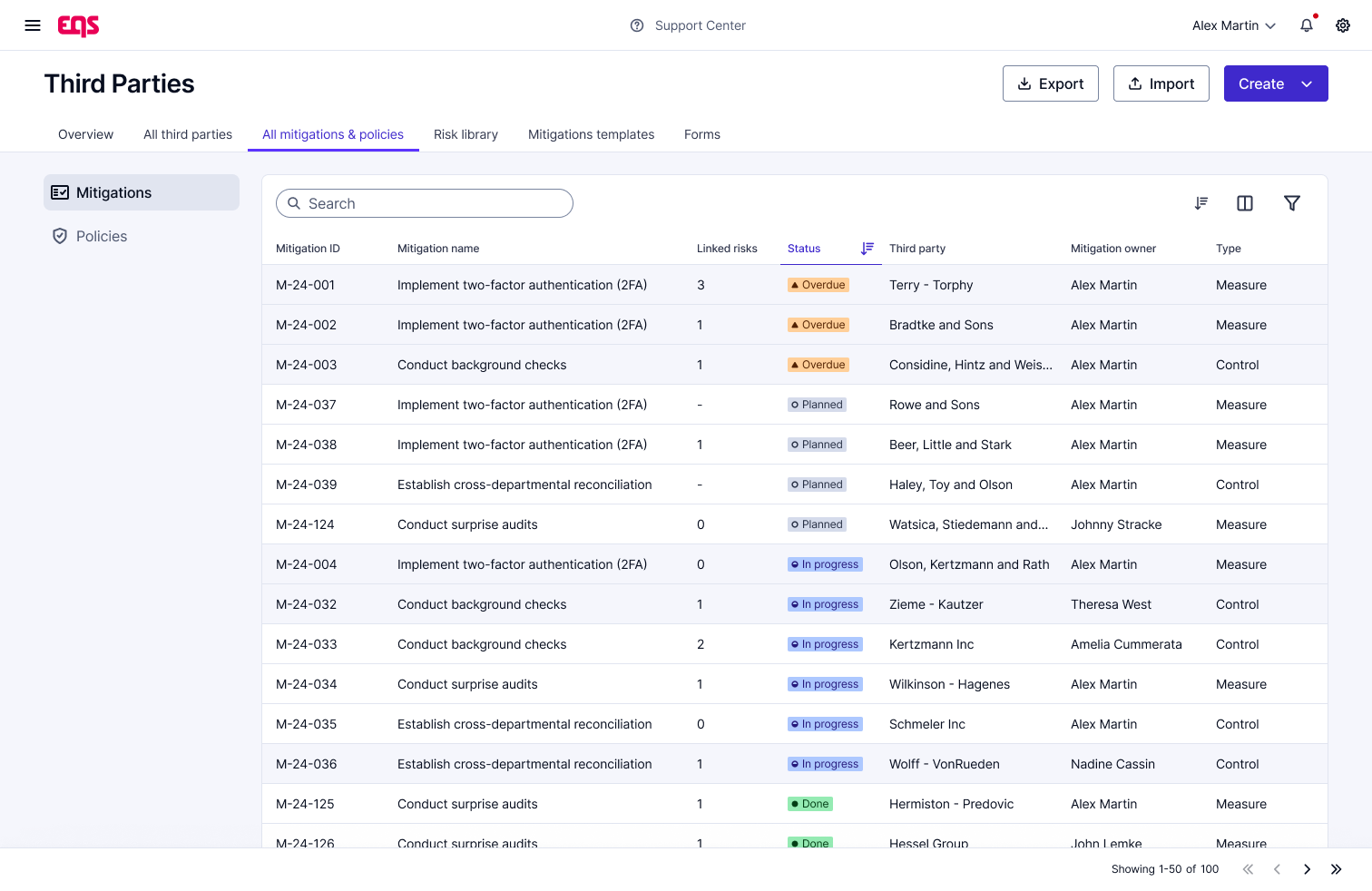

Reviews, controls, and mitigations are tracked in real time. Automated notifications ensure risk or relationship owners see what needs attention immediately. This allows your team to stay ahead of obligations instead of reacting to them.

What makes Third Parties the platform teams rely on

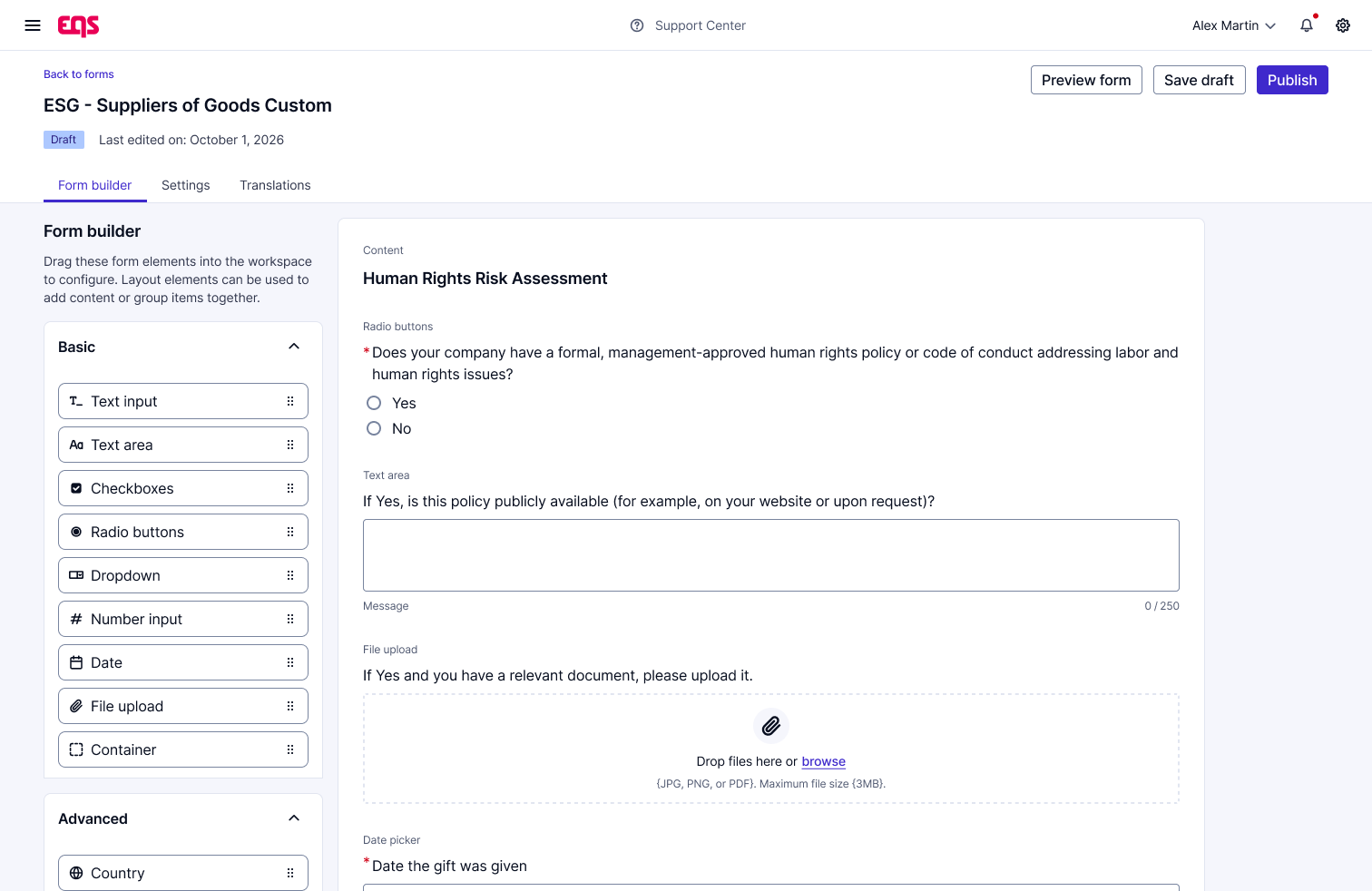

Configurable questionnaires enable risk-based due diligence

Our third-party due diligence software allows you to build questionnaires using expert-curated templates, including Anti-Bribery and Corruption, ESG, Data Privacy, Health and Safety, and UBO, and tailor them using drag-and-drop builder to match your risk approach. Questionnaires can be shared with multiple contacts, and counterparties complete them via a secure, autosaving, login-free process.

Structured profiles deliver clean, consistent third-party data collection

The vendor risk scoring tool is built on a process that ensures all information is collected in clean, structured profiles: company details, contacts, financials, risk indicators, and LkSG relevance. This structured collection process allows you to start with consistent data and make decisions with full context.

Comprehensive oversight and accountability

Oversight of reviews, mitigations, and assessments remains visible with in-app notifications that alert when an action is required. Role-based permissions ensure only the right people can view, edit, assign, or export data. Every action is logged for accountability.

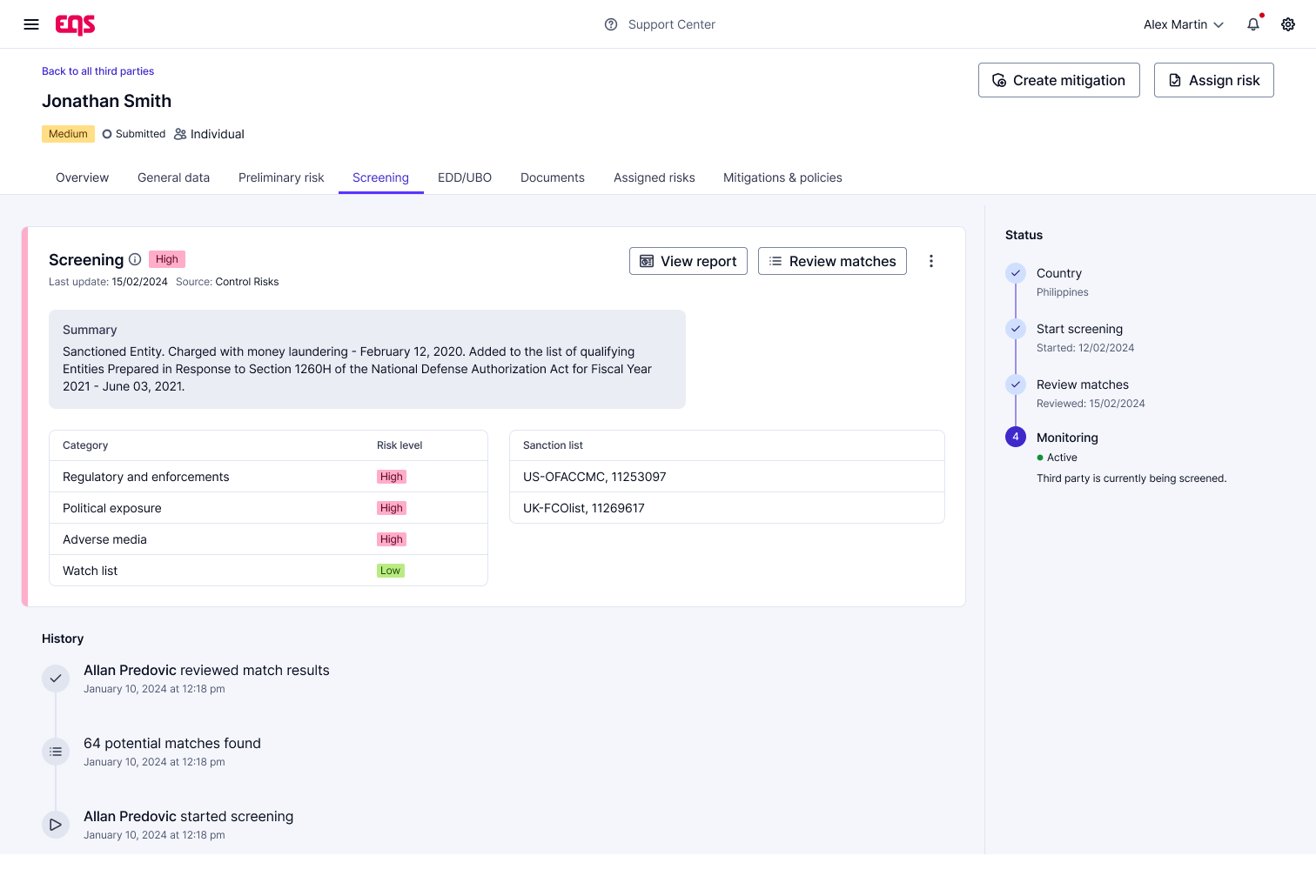

Integrated screening for faster risk validation

Identify potential red flags early with built-in screening checks. Screening results are stored directly in the third-party profile, making risk classification and ongoing monitoring easier and more efficient.

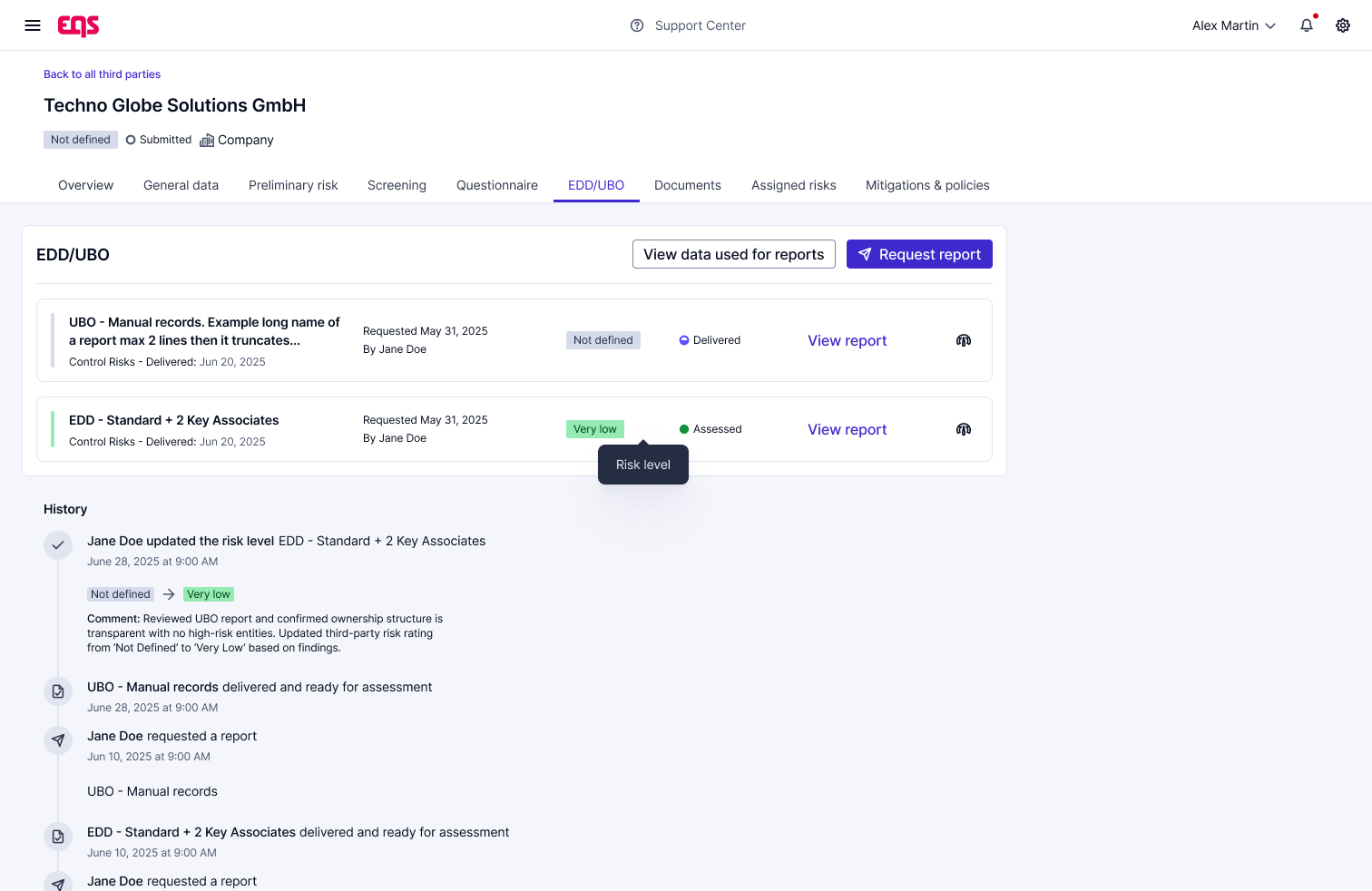

Enhanced Due Diligence and Ultimate Beneficial Ownership reports

Enhanced Due Diligence (EDD) and Ultimate Beneficial Ownership (UBO) reports enable you to request structured, analyst-led investigations when enhanced ownership tracing or deeper risk validation is required.

Once a report is delivered, you can assign a risk level, add internal comments, and download the full PDF. A complete history log is automatically maintained.

From manual tasks to a connected third-party workflow

| Manual and fragmented process | EQS-guided, connected process |

|---|---|

| Data scattered across emails and spreadsheets | One clear profile for every counterparty with all information connected |

| Questionnaires sent manually as Excel files with slow turnaround | Configurable assessments, trackable, and completed via secure links and autosave |

| Policies shared by email with no reliable record | Policy attestations captured in platform with appropriate versioning and timestamp |

| Deadlines missed because reminders get lost in inboxes | In-app notifications that keep every review and mitigation on track |

| Limited visibility into ownership and next steps | Clear ownership with role-based permissions and full accountability |

| Due diligence preparation requires searching, stitching, and explaining | Traceable and exportable records available in seconds |

Proven in practice

Across industries, we see the same pattern: once teams bring their third-party data, assessments, risks, and policy attestations into a single, structured process, the entire program becomes easier to manage and far more reliable.

Reviews move faster because information is consolidated.

Policy attestations are recorded with confidence, not stitched together from email trails.

Due diligence becomes more transparent because everything is in the same, connected picture.

Whether teams are strengthening their ABAC compliance for the UK Bribery Act and FCPA, or maturing supply-chain processes for LkSG and the EU Supply Chain Due Diligence Directive (CSDDD), EQS Third Parties provides the foundation built for clarity, visibility, and accountability.

The EQS difference

Most policy tracking and reporting software focuses only on the upload. EQS uses the entire Integrity Hub ecosystem to ensure your policies are understood, acknowledged, and embedded into your corporate culture.

This four-step workflow reflects how a modern third party risk management software supports the full risk lifecycle.

Collect

Centralize third-party data with structured intake, internal questionnaires, and business justification.

Validate

Evaluate screening results, inherent risk indicators, and external questionnaires to classify and compare risks consistently.

Attest

Send policies and capture third-party attestation tied to the correct policy version.

Monitor

Track reviews, mitigations, and renewals through in-app notifications and comprehensive dashboards.

What compliance officers

really want to know

What is the security and data infrastructure that ensures the protection of our sensitive data?

EQS provides ISO-certified infrastructure, encryption in transit and at rest, configurable access controls, and complete activity logs. All data you store about your third parties is processed in line with GDPR and supports your internal governance, audit, and compliance requirements.

Can we tailor questionnaires to our risk framework and internal standards?

Yes. Choose from expert-curated templates, edit those to your terminology and preferred structure, or create your own questionnaires to match your precise requirements. You decide which questionnaires to use based on the risk level and type of third-party relationship, supporting a fully risk-based due diligence platform approach.

How easily can we adapt the module to our unique internal risk framework and terminology?

You can configure processes and tailor risk-scoring logic to match your internal requirements and risk appetite. This ensures your third-party risk management program isn’t shoehorned into a rigid software model but reflects the reality of your business operations.

What tools are available to help us proactively monitor vendor risk and manage critical deadlines?

EQS Third Parties gives you a complete set of tools to stay ahead of vendor risk. Review cycles, policy commitments, assessments, screenings, and mitigation deadlines, all tracked within one platform. In-app notifications alert owners as soon as something needs attention, and dashboards highlight which third-parties require follow-up.

Resources to help you go further

How to digitize your third-party risk management program

A practical guide for teams transitioning away from manual workflows.

Why a risk-based TPRM approach protects your business

Learn how to prioritize risk, reduce exposure, and improve audit readiness.

Our experts are your partners

|

Sabela Pérez Director of Compliance and Ethics Leads development of modern ethics and compliance solutions used across global organizations |

|

Matthias Zastrow VP, Sales and Compliance Solutions Specialist Provides practical guidance on implementing compliance programs across multiple jurisdictions, not generic sales pitches. |

with a compliance expert