“If companies do not engage in ESG properly, they will be costed out of business”

ESG as a success factor: The experts from "Investor Update" tell us what companies need to know.

ESG or Environmental, Social and Corporate Governance has become an increasingly important topic in recent years. Companies and investors, and also governments and regulatory authorities, now place great value on sustainable management. Greenwashing or simply paying lip service to sustainability is no longer an option for companies. Why? Because society’s awareness of environmental and social issues is growing. The Fridays for Future movement and the Covid-19 pandemic have only intensified this phenomenon. So what does this mean for companies? How can they meet ESG requirements?

A recent White Paper from Investor Update entitled The Corporate ESG Guide: a 360 view on the current landscape and trends provides answers to these questions. We spoke to the authors of the study about why ESG has become so important in recent years and what companies need to consider when it comes to their strategy.

What does ESG mean and why has it become so important in recent years?

Dr Elena Zharikova (EZ): “ESG is an acronym for environmental, social and governance factors that can present both risks and opportunities to companies. Which material factors are relevant are highly individual to each company.

For example, the environmental factor comprises the effects of the onset of climate change. This is something very important to most of our study participants. Carbon emissions is another important aspect, especially for investors. But water scarcity, air pollution and waste also factor in. As far as social factors are concerned, human rights, diversity, data security and of course – driven by the pandemic – labour relations and health and safety are top priorities. In the area of governance, the main issues are the right board composition, independence and board remuneration.”

Patrick Mitchell (PM): “To summarise, ESG actually represents all non-financial aspects. However, over time, we predict that companies will blend ESG with financial reporting.”

Has climate change entered the financial world’s consciousness?

PM: “In 2020, the pandemic has put social factors related to ESG on the corporate agenda. Last year it was environmental issues. We called it the ‘Greta effect’ (editor’s note: after Greta Thunberg, climate activist).”

EZ: “Awareness of climate change has increased greatly in recent years, partly because the effects are becoming more apparent. Even former sceptics are now realising that these problems exist and are demanding solutions.

In the financial sector, companies are now really beginning to realise the impact that climate issues have on a company’s business and how it affects its business model and resilience. Companies are doubly affected: for example, if they do not reduce their carbon emissions, they will get bad press, obviously, but they will also eventually feel the impact on their business operations, for example in the form of extreme weather conditions.” In other words, in meeting ESG criteria, companies are no longer just protecting their reputation, but also their bottom line?

PM: “Absolutely. If companies do not engage in ESG properly, they will be costed out of business. The cost of capital will go through the roof. The banks are already looking at ESG ratings. The worse the rating, the more expensive the loan and they will lose access to the green bond market.

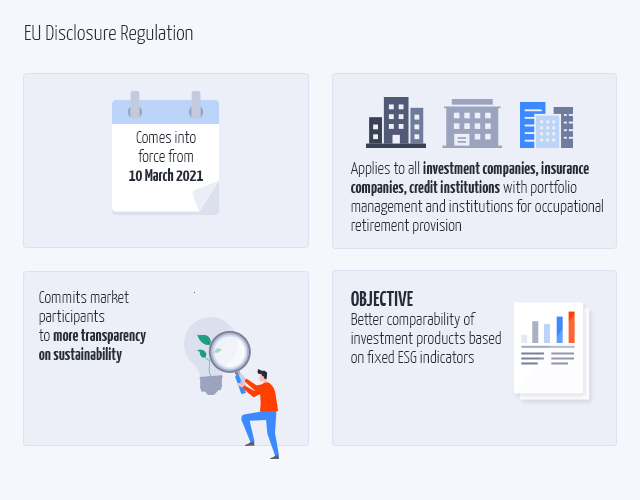

Under proposed changes to the MiFID regime which are likely to be adopted in 2021, all EU institutional investors will also have to ask their clients about their ESG preferences. This will be required by law. And I cannot imagine any millennial or pension fund saying: No, I don’t care about ESG.”

What will be the big ESG trend in 2021?

PM: “Impact investing will grow exponentially.”

EZ: “This is a special form of investing which currently represents a small part of the ESG universe but it is growing steadily. It involves investing in companies that have a measurable impact on environment or social issues, such as access to water, medical care or environmental conditions. Millennials and Generation Z will want to actively invest in companies that make tangible changes. We already see this happening.”

We are seeing private investors engaging in impact investing. Are investment companies also going in this direction?

PM: “Yes, absolutely, and this being driven by millenials. If I had been asked about it in January 2020, I would have said, yes, of course, it is important to protect our planet. But now something is happening. The changes are coming from governments and regulators. Companies that fail to adapt will not survive. The importance of ESG has gained such momentum in recent months that many are unprepared for it. And I’ve been talking to a lot of companies in the last few weeks and they still say ‘yes, yes, I’ll look into ESG as soon as I have time’. This is not enough, it has to happen now.

Scandinavian companies are much better positioned here. It’s part of their DNA. They have been doing it for 20 years. Novo Nordisk is a good example: many of its senior management team are on the board because of their ESG credentials. Traditional companies should be guided by this. In the end, the question for them is not only how much they can gain from ESG, but above all how much they could lose as a result.”

What are the biggest challenges for issuers in terms of ESG?

PM: “There are three main standards: GRI, TCFD and SASB. Many companies do not know which one to follow because they all have different priorities.”

EZ: “Correct. This confuses companies. In addition, ESG as a term is not clearly defined and is relatively new. There are many companies in Europe that focus on ESG criteria, for example good working conditions, but they do not even realise that this relates to ESG criteria because the terminology is unclear. This in turn means that they do not communicate it properly on the market and neither investors nor rating agencies can take it into account.”

PM: “The first piece of advice we give to companies is always don’t panic – the whole ESG area is still relatively new. We therefore recommend companies take a breath first and ask: where do we stand in comparison to our competitors? And what should next steps be?”

A major problem is that there is no uniform, mandatory standard. What standard do we need and who should set it?

PM: “In my opinion, companies should spend less time responding to the myriad of requests which come from rating agencies and more time thinking about which framework makes sense for them. I strongly recommend SASB, a standard set with the help of the major financial institutions. Because in the end, companies want to attract investment so they need to look at who the buy side follows. GRI is more granular and is important for other stakeholders. So this makes sense, too. TCFD focuses on the company’s carbon footprint and it will be made mandatory by regulators in two years. So it makes sense to deal with this issue in advance. Therefore unfortunately, my uncomfortable answer is that companies should follow all three standards. At least until these are either unified in part or in full. This is the only way to keep everyone happy.”

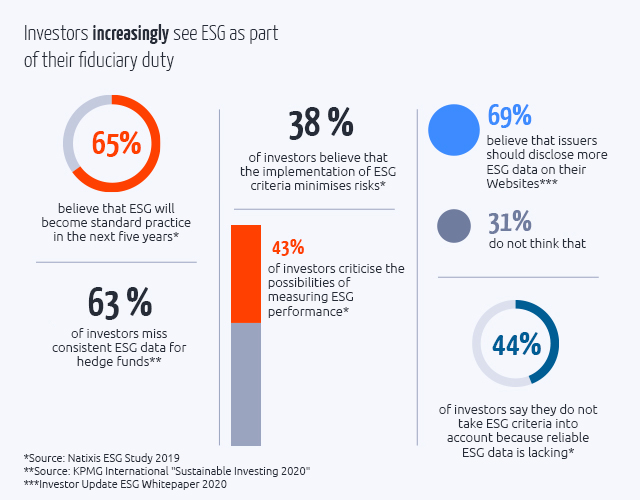

EZ: “Our ESG study showed that all parties involved have a common desire for uniform disclosure standards. Issuers would have less work because they would not have to comply with three different standards, investors would have less work in analysing investments and rating agencies would also benefit because they would not have this vast amount of incomparable data. The industry is calling for a single, uniform and mandatory standard set by the regulators. The Taxonomy Regulation recently introduced by the EU is a significant step in this direction.

What was the most surprising finding from the study?

PM: “I am not quite sure whether the rating agencies know how opaque they are. Of course they have to be to a certain extent, because they are in competition with each other, but for companies it is very difficult. They have nowhere to call and discuss the outcome. One of our interview participants from Scandinavia, for example, simply no longer engages with rating agencies. Instead, they publish all their ESG data on their website, making it easily accessible to everyone. This is probably the direction of travel. Rating agencies would like that, they can use and process the information directly, but if they are not careful, they will soon cease to be rating bodies and become research entities collecting information.

It becomes problematic when you cannot rely on this information. The ratings of the various agencies are often so far apart. And I can understand that they all have a different focus, but it is unacceptable for them to have such different ratings. This is neither transparent nor conclusive; we require a uniform framework for all relevant data, which then has to be audited. But until this happens we will just have to live with how things are.”

EZ: “I found it very interesting to see that there is a great deal of understanding among investors that companies are still in a transitional stage with regards ESG. They are also very aware of the different criteria and the lack of standardisation. They know how difficult it is to meet current standards. ESG is still a developing area.”

PM: “At the moment everyone is still very understanding, but that will change at some point, at the latest when the data improves. Then it really will be down to the companies to act.”

EQS IR COCKPIT is the world’s first platform which brings together and coordinates investor data, contact management, disclosure obligations and news distribution in one tool