Best Practice: How to Prepare your IPO Website

Tips for your IPO website and the time after the going public

The CEO visits the trading floor and rings the bell on the first day of trading. Just like that the company is listed on the stock exchange for the first time. A huge opportunity but not without risks and requirements.

Many employees have been working towards this day for months. They have ensured the company is fit for listing and met all legal, economic and organizational requirements; they have mandated lawyers, (syndicate) banks, auditors and agencies to accompany the IPO – and naturally they have also drafted an investment case to attract investors.

Intention to Float: Now it Gets Serious

All of this has largely taken place behind closed doors. Things start getting serious when a company files an Intention to Float (ITF) for their Initial Public Offering (IPO), usually four weeks before their first trading day. This is a formal declaration announcing their move to the market.

Now the company is officially under the watchful eye of the capital markets and is therefore obliged to communicate with (potential) investors, financial journalists and analysts. The IR website, a first point of contact for stakeholders searching for information, plays a central role here.

During the ITF phase companies usually make very little information available online: the most important information at this stage are the ITF announcement and the investor relations officer’s contact details.

However, even at this stage it’s important to ensure that visitors to your IR website feel they are in good hands, can find the information they need quickly and – if possible – in one click. The IR website should be in the corporate design to ensure familiarity for visitors.

Stock Exchange Prospectus: Detailed Information – but Not Accessible to All Website Visitors

10 to 14 days following the Intention to Float is the next step before the IPO: the publication of the prospectus. In this PDF document, which is uploaded to the website, investors can read several hundreds of pages detailing the issuer’s offer and all the information they need to weigh up the opportunities and risks associated with an investment. This includes information on business activities, the market and competitive environment, as well as key financial figures.

However, this information is not intended for all visitors to the website as the regulations often prohibit access to this information from the United States, Canada, Japan and Australia. This is indicated in a disclaimer. As a rule, this disclaimer is included in the IR website up to four weeks after a successful IPO.

When the IPO bell rings, the work on the IR website really gets started.

Up-To-Date, Informative and Attractive – the IR Website from the IPO Onwards

Like a butterfly, the IR website spreads its wings and shows its full glory at the final stage, with a successful IPO. At this point companies must meet certain regulatory requirements and publish certain announcements and dates. However, an IR website must do more than simply present prices and figures, facts and financial reports.

The digital world offers many possibilities to present content in an attractive way. While the information must of course be up-to-date and informative it needs to provoke some kind of emotional response in order to be memorable.

Everything at a Glance

So how should a modern IR website be structured to offer the reader real added-value? Short answer: it needs to be clear and concise. Any visitor who needs to search for the desired content won’t spend long on your IR website – and might also as a result draw negative conclusions about your company’s investment case.

Clear teaser sections provide an overview of the latest publications, the share price, upcoming dates and key financial figures on the home page and allow users direct, uncomplicated access to the desired information.

Draw Readers in with Interactive Elements

Your investment case should appeal to both stakeholders’ heads and hearts. Modern communication methods using interactive elements can be really helpful here and are playing an increasingly important role on IR websites.

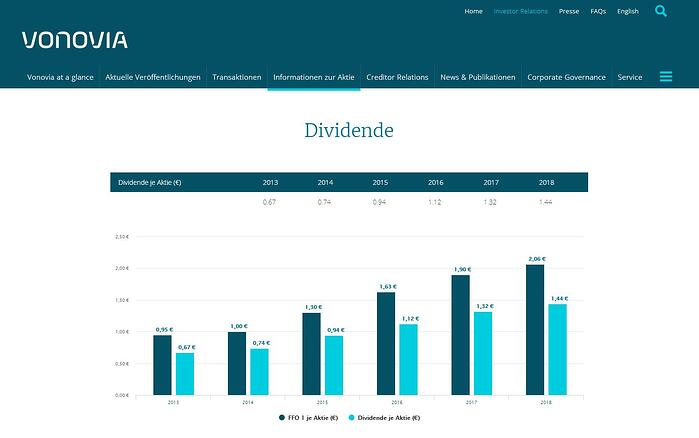

- The sustainability or attractiveness of an investment can be demonstrated with an interactive Performance Calculator. Graphics and detailed performance overviews for selected periods present developments in a clear way – with or without taking the dividend into account, as required.

- The interactive Stock Chart shows the share price development on various exchanges (where relevant). It can also include the broader context via automatic news integration. You can also find out where the shares are currently being traded and which stock exchanges are closed.

- The interactive Key Financials Analyzer provides real added value for stakeholders who want to analyze the company’s financial figures. Investors and analysts can view revenue, EBIT or any other measures for a specific year and then print or export the results to multiple formats.

- Issuers who have also issued a bond can use the interactive Maturity Profile to give their creditors a good overview of the debt structure and maturity of the bonds and financial liabilities.

- The Financial Calendar now offers more than just a chronological list of all dates. The filter function enables readers to select the event type they want displayed, for example, roadshows or financial publications. The Event Reminder reminds stakeholders of upcoming events.

- The automated News Alert informs investors and analysts when regulatory news, new inside information, corporate news, voting rights announcements or press releases have been published.

- A Financial Glossary and an integrated Glossary Function, which explains abbreviations and company-specific technical terms, increases the time users spend on the website.

Tell Us About Yourself

Information needs are as diverse as the stakeholders who visit your IR website, so it pays to make a wide range of information available. Investors and analysts naturally demand facts, but they are also open to an emotional approach: so make your company’s investment case, describe your business model and explain, clearly and understandably, why you should receive their investment. Very important: introduce the top management, this creates trust and familiarity among readers.

Sometimes, however, people need that personal contact. Make it clear that people can get in touch, for example using an online form. Contact details and photos of IR contacts should also be easy to find.

SEO: Always Easy to Find

The challenge with an IR website is to harmonize modern technologies with a fresh design and simple user navigation. Because even the best interactive elements miss their mark if the overall concept of the IR website is wrong.

Naturally this also means IR information should be easily found on the internet. In addition to a Teaser Chart on the company’s homepage for quick access, you should also consider Search Engine Optimization (SEO).

Make sure you have a responsive design. This allows tablet and smartphone users the ability to access your website as conveniently as they would as on a desktop PC at home. One positive side-effect: responsive websites are ranked highly by Google so this can also lead to improved discoverability. In addition, take account of the fact that more than half of all visits to IR websites are now made from mobile devices.

Conclusion: The IR Website as Your Company Calling Card

One last thing: it is only after the IPO that the work really starts. The IR section must be maintained, continuously updated and optimized. This is the only way it will serve as a representative calling card for your company.

Simplify the work with a holistic approach that focuses on automated processes and integrated workflows – and serves all communication channels with a single step. This will enable you to offer an attractive IR website, even with limited resources.

Is your company thinking about going public?

We would be pleased to offer our advice and help you make an excellent first impression from the beginning.

Infographic: 7 Interactive Elements That Make Your IR Website Even More Attractive

Move your IR communication forward!

With our EQS IR Tools you provide interactive experiences for your IR website