Why Preventing Money Laundering Needs to Be a Top Priority for Companies

A look at the legal situation and tips for companies to prevent money laundering within their own ranks.

Money laundering crimes are becoming ever more sophisticated and lawmakers are tightening regulations accordingly. With the 5th EU Anti-Money Laundering Directive coming into force this year, obligations on business are increasing – and failing to meet these obligations could have serious repercussions.

What is money laundering?

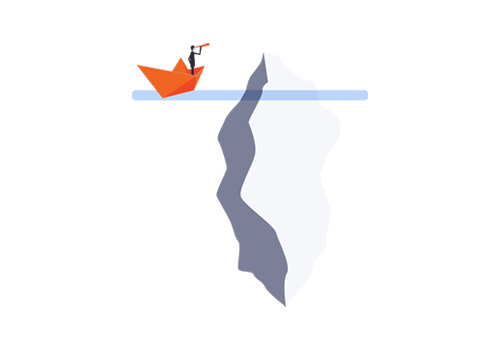

Money laundering is the process of disguising the proceeds of crime by taking “dirty” money derived from criminal activity and integrating it into the legitimate financial system, thus “cleaning” it. According to the International Monetary Fund, the amount of money laundered worldwide every year is estimated to be between $600 billion and $1.5 trillion.

Which businesses are at risk?

Big and small alike, but criminals are using more sophisticated means to remain undetected. Increasingly, legitimate businesses in industries traditionally perceived as low risk are inadvertently acting as intermediaries in the “layering” phase of money laundering (transactions which obscure the audit trail and sever the link with the original crime). Criminals are known to target small and medium sized companies because they often lack experience and knowledge about the risks involved with certain types of transactions, and do not have robust anti-money-laundering procedures in place.

What does the law say?

The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. Legislation now in force states that companies to which the law applies (so-called obliged entities) are obliged to do the following.

- Undertake risk management and implement internal risk management measures

- Apply customer due diligence processes when entering into a business relationship (Know Your Customer – KYC) which not only involves identifying the customer, but also any person acting on their behalf and any beneficial owners.

- Obtain information on the purpose and the type of business relationship and evaluate where not self-explanatory.

- Conduct continuous monitoring of the business relationship or transactions processed. As part of this continuous monitoring, the obliged parties must ensure that the relevant documents, data or information are updated within an appropriate timeframe taking into account the relevant risk. These measures make it possible to retrace cash flows and to discover uncommon or even suspicious transactions or business relationships.

- Report any suspicious transactions to the relevant national reporting body.

The EU periodically issues anti-money laundering Directives (AMLD) and all EU member states must abide by these and integrate them into their national legislation.

With the 5th EU Anti-Money Laundering Directive (5AMLD), which for example came into force in Germany on 10th January 2020, the European legislator now intends to further improve the preventative regime, with the aim of more effectively combating money laundering practices and terrorist financing.

The 5AMLD chiefly:

- Expands the circle of obliged entities under anti money laundering rules to include

- cryptocurrencies and cryptocurrency exchanges

- a broader definition of companies providing tax advisory services which may affect lawyers who provide assistance in tax matters on a commercial basis

- art traders if a transaction or series of transactions amounts to €10,000 or more

- real estate agents who broker rental or lease agreements with the restriction that the respective mediated transaction amounts to a monthly rent of €10,000 or more.

- See an exhaustive list of obliged entities under the German Anti-Money Laundering Act (sec. 2 para. 1)

- Introduces new usage obligations for obliged entities: in the future, obliged entities must obtain proof of registration in the beneficial ownership register or an extract from the beneficial ownership register ‘if necessary’ and report any inconsistencies they discover between the information on beneficial owners included in the beneficial ownership register and the information on beneficial owners available to them.

- Creates a more stringent standard of due care for business relationships relating to high-risk third countries.

- Extends public access to the beneficial ownership register which ensures details of the beneficial ownership of companies are available for public scrutiny. The ownership of trusts will also be available to competent bodies with a legitimate interest.

- Lifts the anonymity on electronic money products (prepaid cards) in particular when used online.

- In addition, EU member states are now obliged to create a list of national public offices and functions that qualify as politically exposed (PEP), create central registries which identify anyone holding or controlling bank or savings accounts and safe deposit boxes and together create an EU-wide electronic European transparency platform (European Transparency Register).

Why is money laundering a risk factor for companies?

With this latest directive, the EU wants to further tighten rules around money laundering. This tightening of restrictions and removal of loopholes is being done by placing greater obligations on those in business – and therefore businesses cannot afford to ignore it.

Failing to meet the requirements of 5AMLD can mean businesses face fines of up to a maximum of €5 million or 10% of annual turnover. Considering the additional reputational damage, along with the fact that individuals can be banned from running a regulated business and an organisation can be prevented from trading, this is a topic that needs to be a top priority for any board.

Tips on how companies can prevent money laundering

Besides fulfilling national anti-money laundering laws companies can take some further steps to fight money-laundering within their own ranks:

- Foster a culture of anti-money laundering and compliance by establishing an official AML policy that indicates appropriate and inappropriate procedures in your company.

- Organise regular training sessions to teach your employees about identifying money laundering situations.

- Implement internal whistleblowing channels that allow their employees to report irregularities in a confidential way.

Utilising an integrated compliance solution offers a fundamental advantage in obtaining in-depth insights.